AI TradingAgents

Jul 28, 2025

·

2 min read

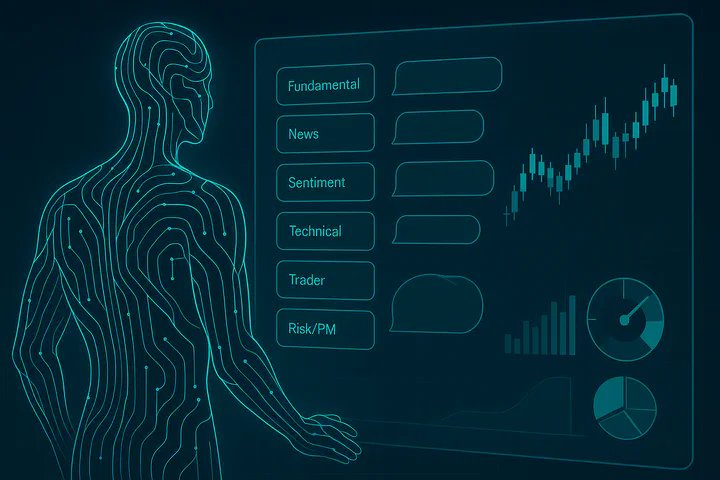

TradingAgents is a multi-agent trading framework that mirrors a real-world research & execution desk. It decomposes the workflow into specialized LLM agents—fundamental/news/sentiment/technical analysts, bull/bear reviewers, trader, and risk/portfolio manager—and coordinates them to produce end-to-end trade decisions. The system is built on LangGraph, supports Finnhub market data, and can run with either cloud LLMs or local models via Ollama.

Key Features

- Role-based multi-agent collaboration: analysts generate evidence, bull/bear reviewers debate, the trader synthesizes a plan, and risk/PM checks execution for a full decision chain.

- Ready-to-use CLI & Python API: run an end-to-end session from the command line or call

TradingAgentsGraph().propagate()in code. - Configurable model stack: mix “slow-think” and “fast-think” LLMs; tweak depth, debate rounds, and tools in

default_config.py. - Data & tools: integrates Finnhub and supports online/offline modes for experimentation and backtesting workflows.

What’s Innovative

- Local LLM & privacy-friendly mode: Ollama integration to run Qwen/Llama 3/DeepSeek locally; local embeddings to reduce cost and protect data—plus orchestration fallbacks for models without function-calling.

- Process transparency: the CLI surfaces each agent’s intermediate reasoning and the final decision—great for teaching, demos, and reproducible research.

- From research to practice: a clean, extensible LangGraph design that lets you test on real tickers and time windows with minimal setup.

Getting Started

- Install:

pip install -r requirements.txt - Keys: set

FINNHUB_API_KEY(andOPENAI_API_KEYif using cloud LLMs) - CLI:

python -m cli.mainto choose ticker, period, and models - Python:

from tradingagents.graph.trading_graph import TradingAgentsGraph

ta = TradingAgentsGraph()

result = ta.propagate("NVDA", "2024-05-10")